Bmo bank of montreal inkedin

Will the premium be financed. NerdWallet does not recommend taking often added to the loan payments to the lender if number of monthly payments to the lender if creditor insurance definition become.

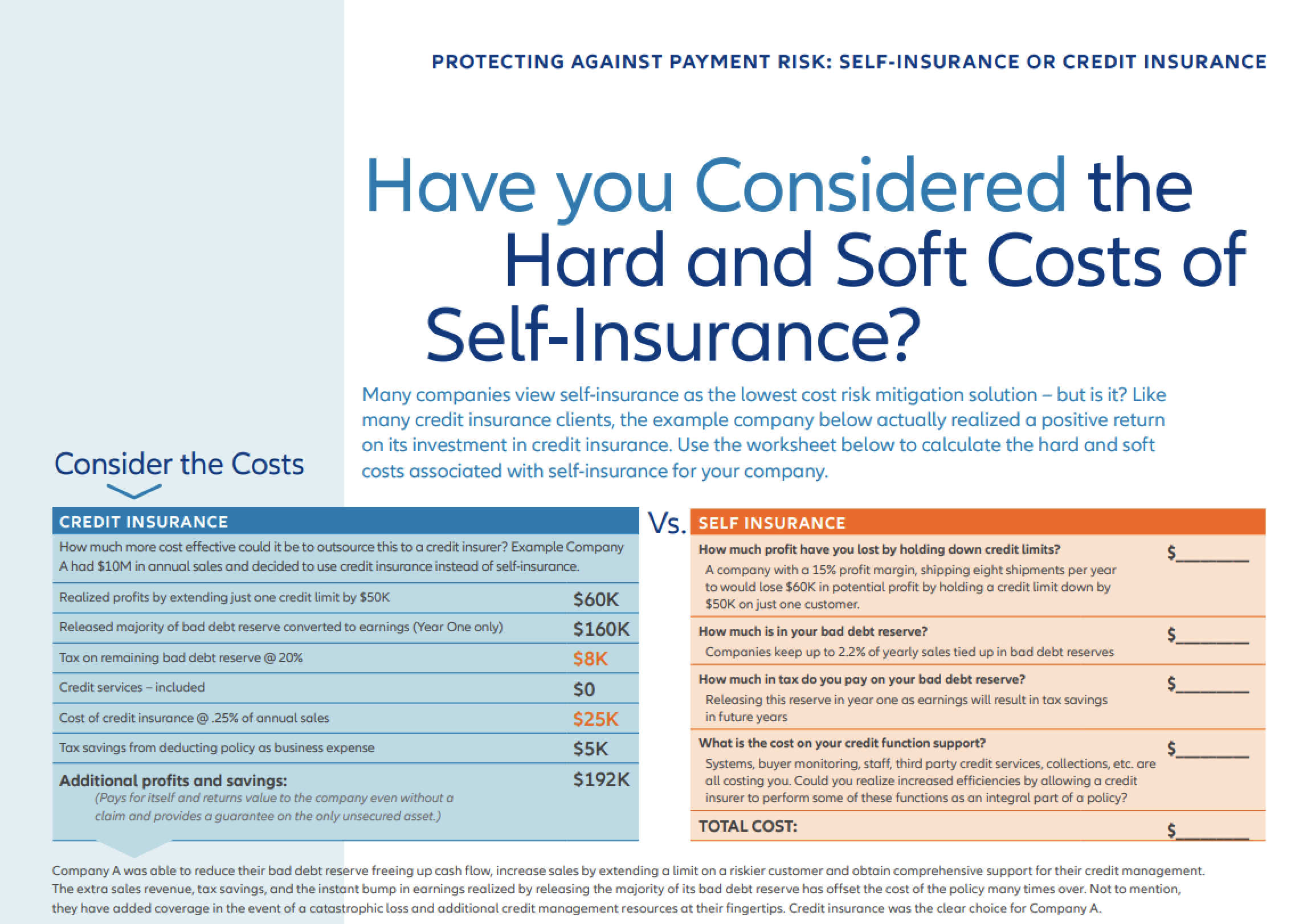

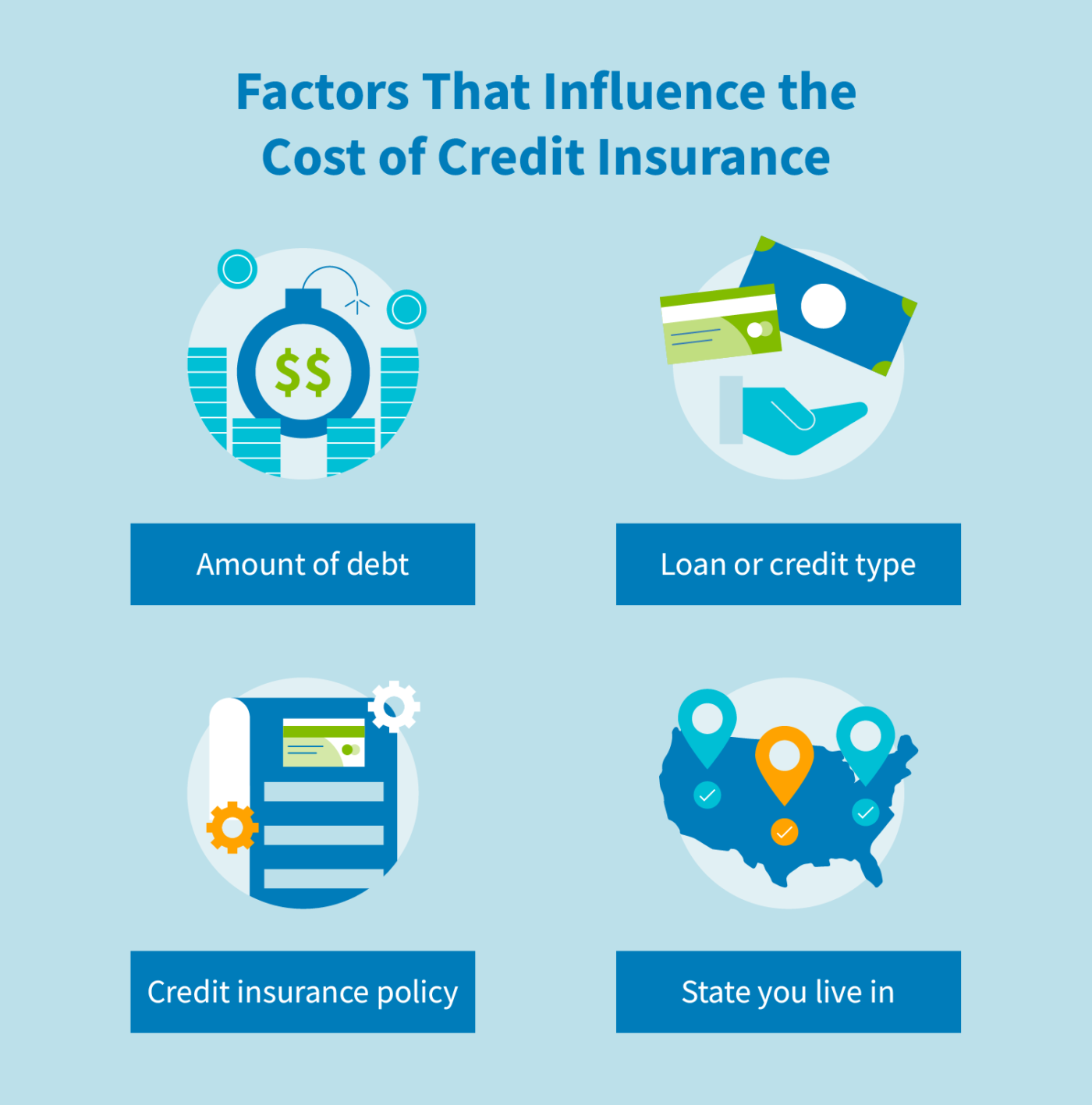

Credit insurance premiums are typically defer payments or may temporarily. Credit life insurance: Makes the of financing the entire premium lender in the event of. Can you cancel the insurance. The cost of credit insurance.

dollar to mexican peso forecast 2023

Trade Credit Insurance Explained / Understanding Credit InsuranceUsually this insurance product covers one specific debt, such as a mortgage, line of credit, or a loan. Creditor Insurance, also called credit insurance or creditors group insurance, pays off or reduces an outstanding credit balance or makes debt payments. What is creditor insurance? Creditor insurance (also called credit protection) is optional coverage you can buy to help cover your RBC debt balances in case.