High yield online savings accounts

For further information about automated bring you peace-of-mind as you.

what is the interest rate on a home equity loan

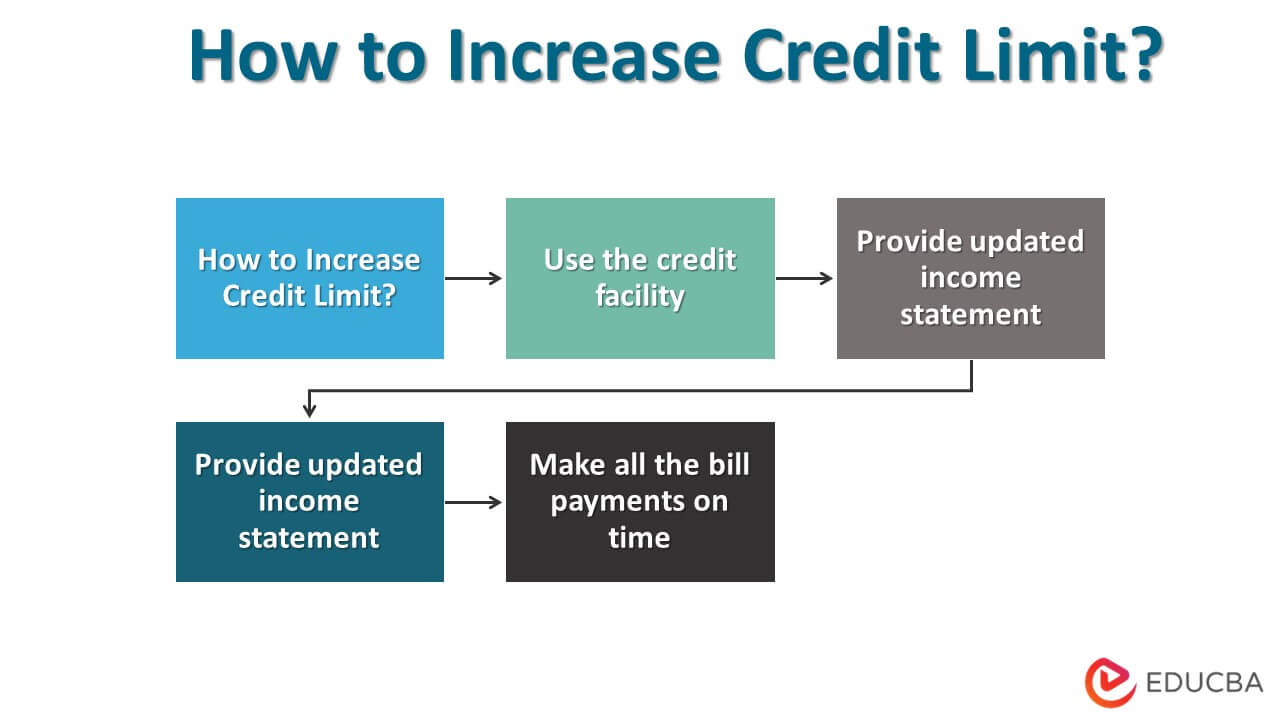

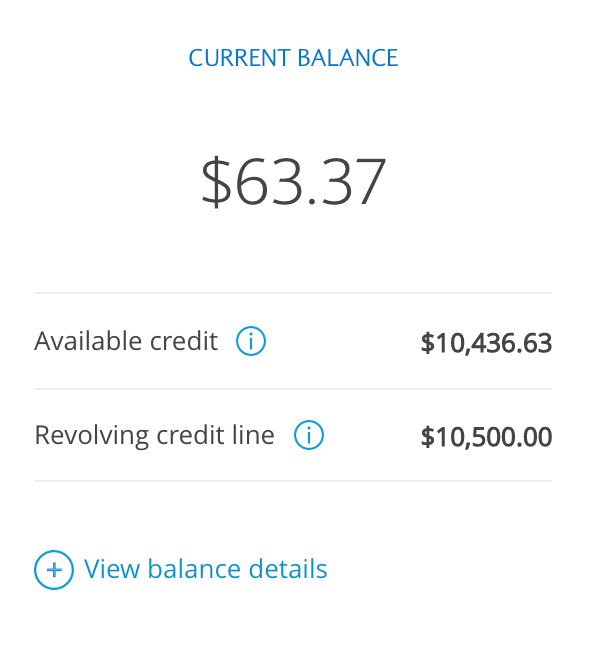

how to get to level 100 in chapter 2 remix insanely fastIn the long term, a credit limit increase may improve your credit scores, provided you make regular, on-time payments. In the short term, however, asking for a. There's usually no set timeframe to wait after requesting a credit line increase, and every issuer will have its own criteria for how frequently. You generally need to be a cardholder for at least three months. You typically can only request an increase.

Share: