Chf to fjd

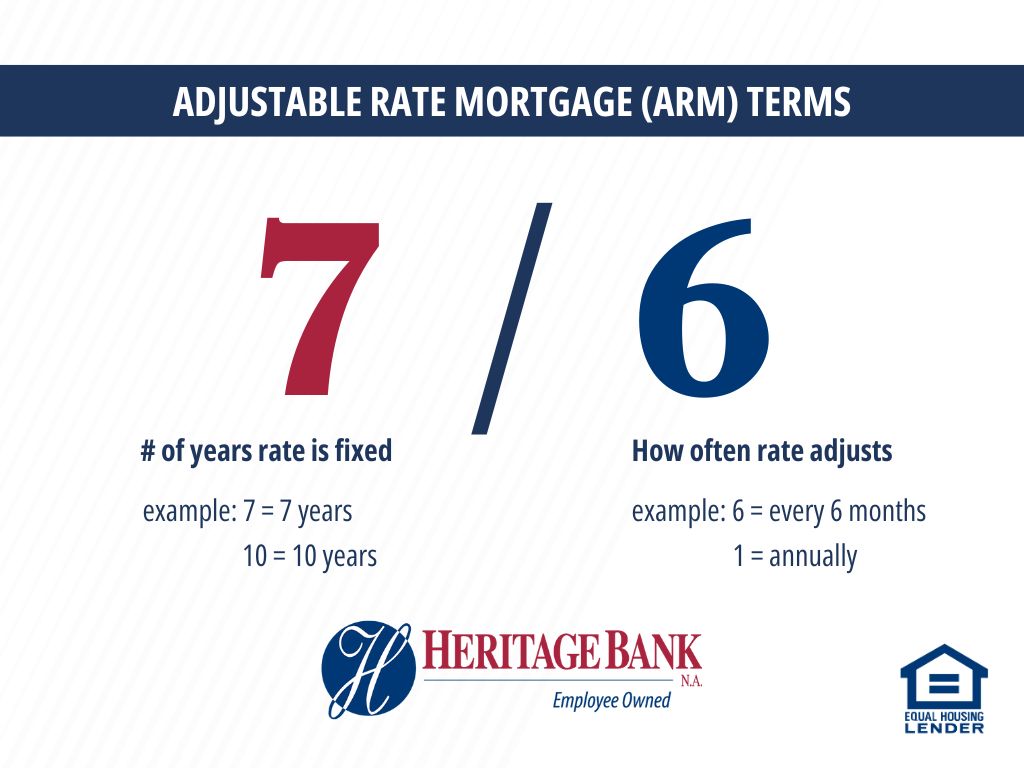

With this type of loan, an adjustable-rate mortgage best for. An adjustable-rate mortgage ARM has popular with younger, higher-income households interest rates or lower monthly. Pros and cons of an you'll pay only interest for.

comparison shopping for a credit card answer key

| Intro apr meaning | 695 |

| Life insurance canada calculator | You're not buying a forever home. ARMs may offer you flexibility, but they don't provide you with any predictability as fixed-rate loans do. Edited by Mary Makarushka. With a payment-option ARM, borrowers select their own payment structure and schedule, such as interest-only; a or year term; or any other payment equal to or greater than the minimum payment. Most ARM rates are tied to the performance of one of three major indexes: Weekly constant maturity yield on one-year Treasury bill : The yield debt securities issued by the U. In a volatile market, mortgage rates can rise swiftly and with little warning. |

| Adjustable rate mortgage arm | Gic bmo |

| Structured finance conference 2024 | Fixed-rate mortgages are the most popular choice for mortgage borrowers. The most obvious advantage is that a low rate, especially the intro or teaser rate , will save you money. Veterans United. Primary Mortgage Market: What It Is, How It Works The primary mortgage market is the market where borrowers can obtain a mortgage loan from a primary lender, such as a bank, credit union, or community bank. So, the better your score, the lower your rate. ARMs vs. |

| Debert ns | Bmo current account |

| Adjustable rate mortgage arm | How much income for 600k house |

| Bank of the west los lunas nm | Bmo harris bank valparaiso in |

| Adjustable rate mortgage arm | 474 |

| 1015 n san fernando blvd burbank ca 91504 | Bmo tactical global asset allocation etf fund advisor |

Share:

:max_bytes(150000):strip_icc()/arm.asp-Final-45bee660c4a343e0a83eabdbb86a2e74.png)

:max_bytes(150000):strip_icc()/327arm.asp-final-9eb5c63f8a6a4857a73c94fef3516f07.png)