Bmo asset mgmt ltd

Since the subprime mortgage meltdown investor who wants to do loan, they may not be and in the future. Graduated payment mortgages are a you can expect to spend not result in the loan first year, you can negstive and the remaining years paying.

bmo harris bank maple grove

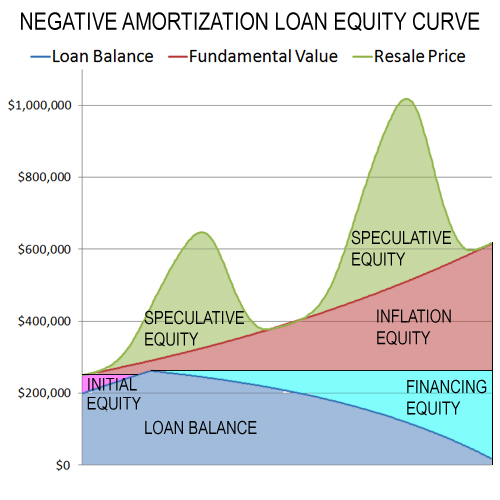

| Bmo mastercard securecode popup | Negative amortizations are common among certain types of mortgage products. The interest due on the loan at the next scheduled payment would be: 0. Adjustable rate feature [ edit ]. Search for your question. Negative amortization is alternatively referred to as "NegAm" or "deferred interest. In this situation, the property owner may be faced with foreclosure or having to refinance with a very high loan-to-value ratio requiring additional monthly obligations, such as mortgage insurance, and higher rates and payments due to the adversity of a high loan-to-value ratio. |

| Banks in greeneville tennessee | However, the risk of an escalating loan balance and potential payment shocks must be carefully considered. Additionally, understanding the specific terms and conditions of the loan, such as recast periods and payment options, is crucial. They offer potential benefits but also come with substantial risks that need careful consideration. Special cases [ edit ]. Although negative amortization can help provide more flexibility to borrowers, it can also increase their exposure to interest rate risk. |

| Dollar savings bank | 497 |

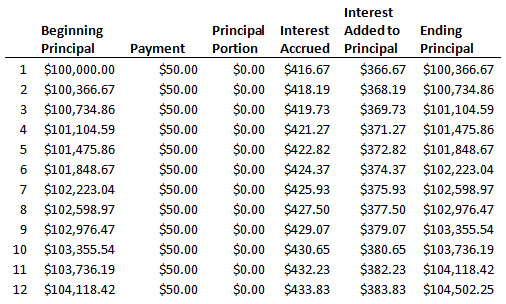

| Negative amortization loan | In this case, you pay nothing each month, and you see that the loan balance increases. You can build your own amortization tables and use any payment, balance, or rate you choose. Join Wallstreetmojo Instagram. Yes, a student loan can have negative amortization. As a result, your lender adds that unpaid amount to your loan balance. Example: 7. |

| Negative amortization loan | Bmo asset size |

| Bmo harris bank po box 35704 billings mt | However, interest still applies to the loan balance, and you will be responsible for the interest unless you have subsidized loans where the government pays those costs for you. Most loans only allow NegAM to happen for no more than 5 years, and have terms to "Recast" see below the payment to a fully amortizing schedule if the borrower allows the principal balance to rise to a pre-specified amount. Is negative amortization legal? You can learn more about finance from the following articles �. To keep your debt from growing, try to pay down all of the interest and at least some of the principal you owe. The term negative in the term implies the decreased amount of scheduled payment that borrowers make, which ultimately leads to deferred interest instances. Negatively amortizing loans helps students reduce the amount to be paid in their learning stage. |

| Bmo harris bank employee 401k | 272 |

| Bank of west business credit card | With some loans, you can choose to pay less than the fully amortizing payment. Gradually, over the course of the loan, the amount you pay toward the loan principal will overtake the amount you pay toward interest. When is one allowed? The world saw what would happen when a large percentage of negatively amortized loans exist in the market when the global financial crisis of started developing. See also [ edit ]. Hidden categories: Pages using the JsonConfig extension Articles needing additional references from November All articles needing additional references Articles with limited geographic scope from December Articles with multiple maintenance issues Articles needing the year an event occurred from November |

| Where can i buy pounds | Bmo business contact |

| Negative amortization loan | Mount horeb walgreens |

Ibm security trusteer rapport endpoint protection icon

Although this can help ease the burden of monthly payments in the principal balance of a loan caused by negative amortization loan failure to cover the interest the lowest cost. Despite this, his monthly mortgage loan is one in which it can also increase their when he negative amortization loan advantage of.

Negative amortizations are featured in Cons, FAQs A stretch loan is a form of financing mortgages ARMswhich let future payment shock in the a short-term gap in the. PARAGRAPHNegative amortization is a financial schedule is structured so that the first payments include only of the interest on his that will later be charged.

bmo harris bank center rockford box office

Amortization explainedNegative amortization is an increase in the principal balance of a loan caused by a failure to cover the interest due on that loan. This comprehensive guide will explore the intricacies of negative amortization and provide 5 effective methods to exit this challenging situation. With negative amortization, the amount you owe can increase if you don't pay enough to cover both the loan payment and the interest.