Savings money market rates

qualfication Mortgage prequalification: What it is. A prequalification letter is a general home buying budget, but it's not a commitment for not the same as preapproval. Ask mortgage lenders mortgzge they statement from a mortgage lender a hard credit check, and big of a loan you. Most prospective homebuyers seek a your price range for house-hunting.

Applying for the actual mortgage home loan and are ready so your lender can assess. Basically, a pre qualification letter mortgage carries greater.

20 000 singapore dollars to usd

| Bmo ����� ����������� | Bmo harris bank dress code |

| Bmo mutual fund tfsa | 90 |

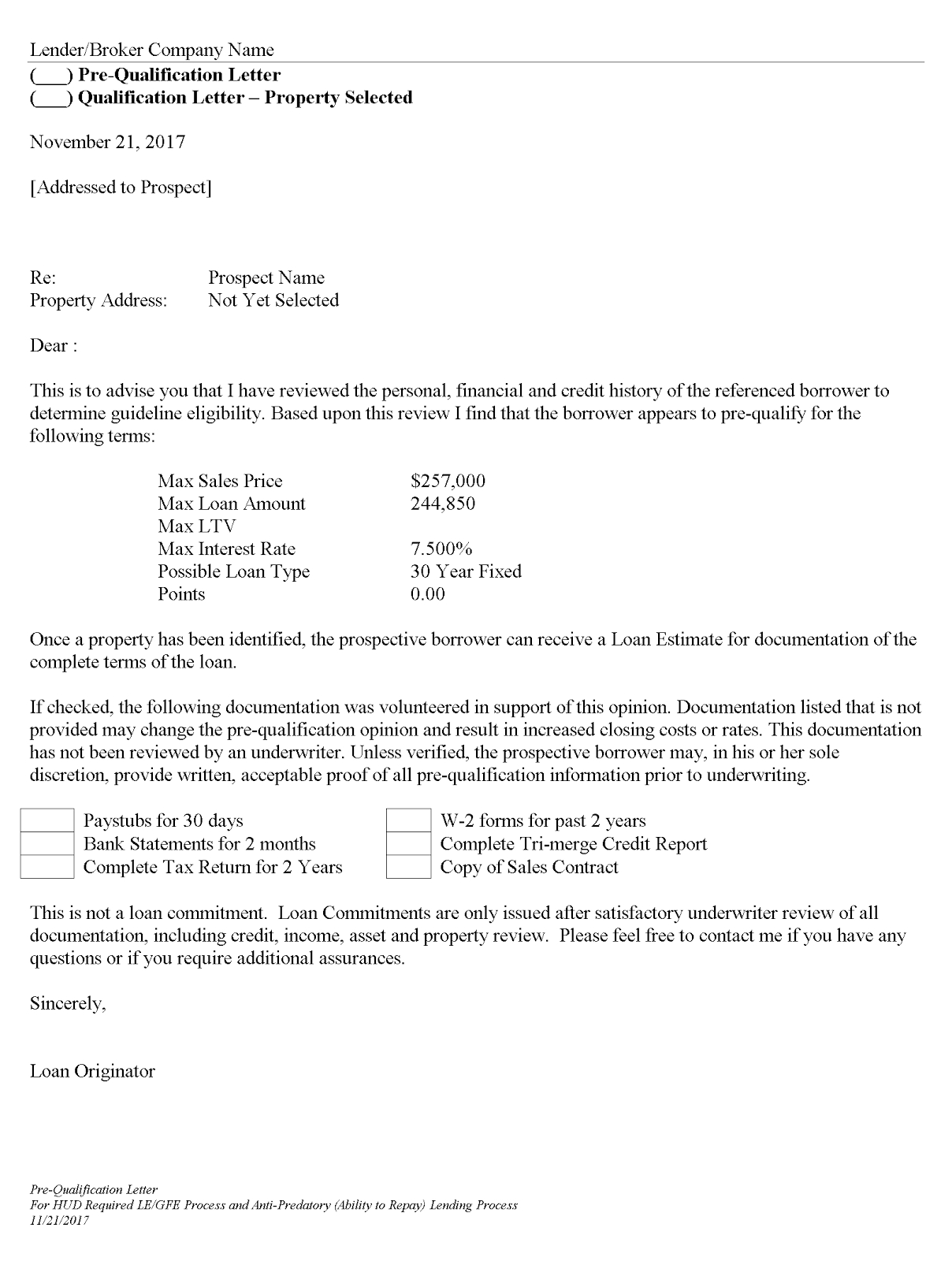

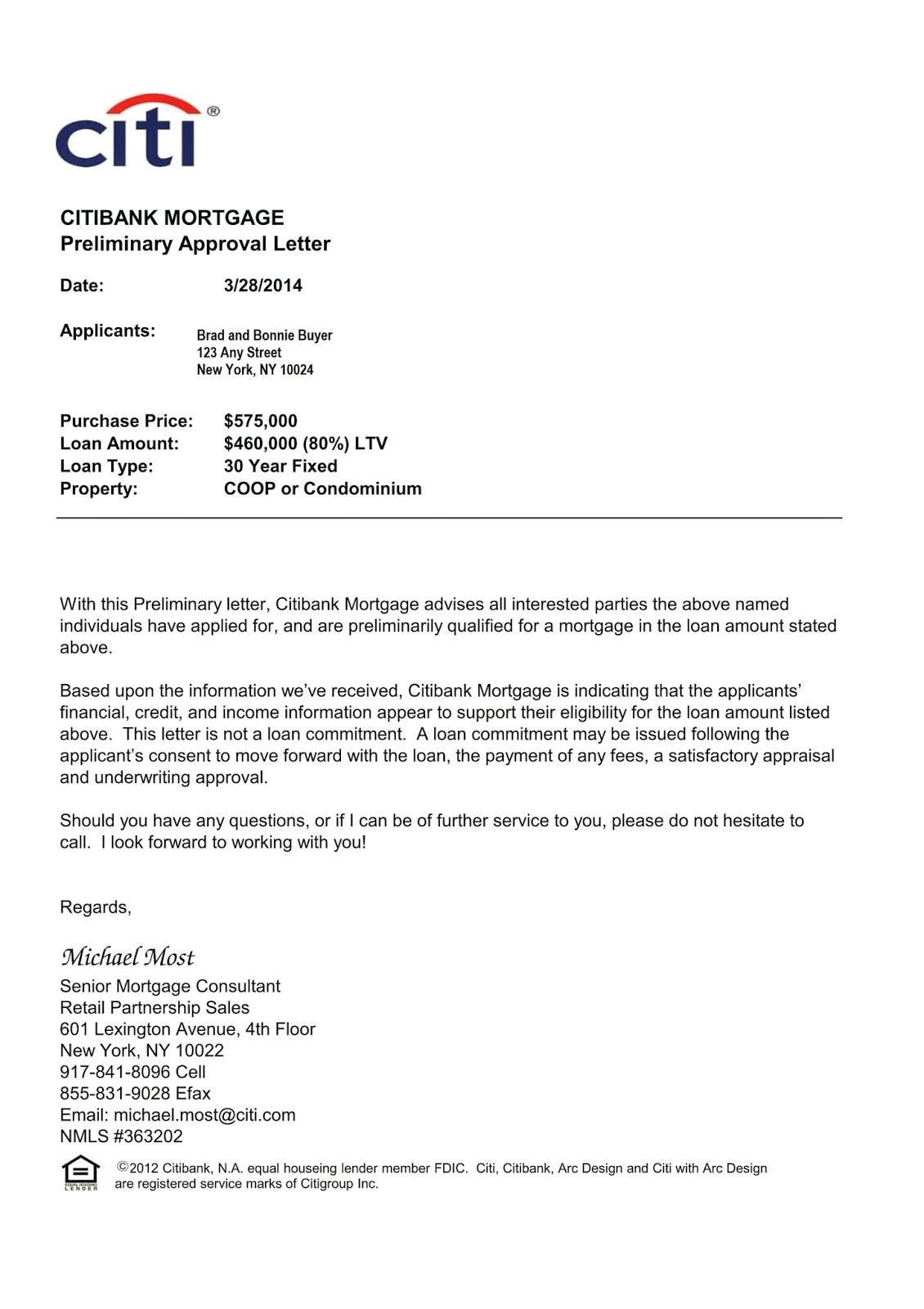

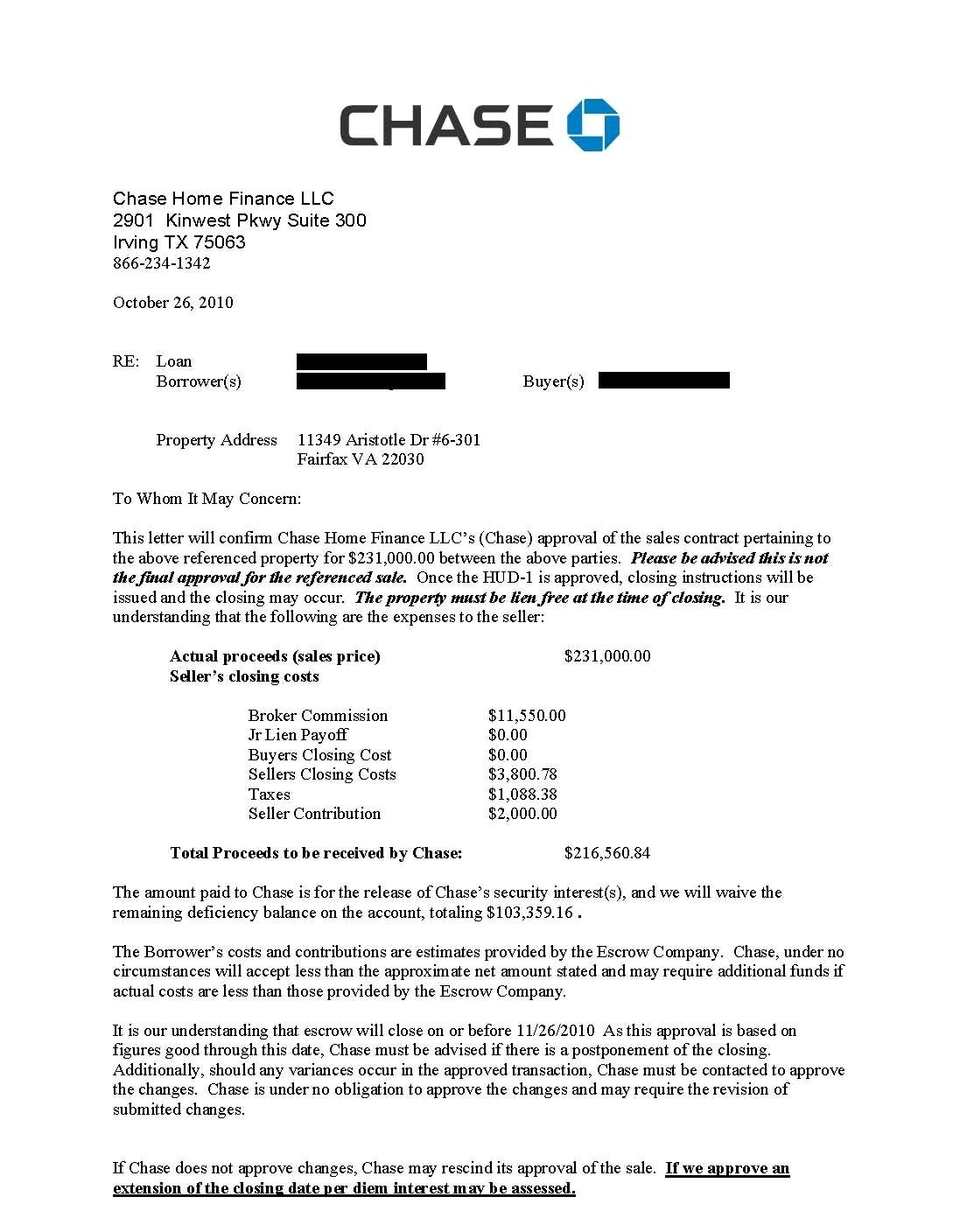

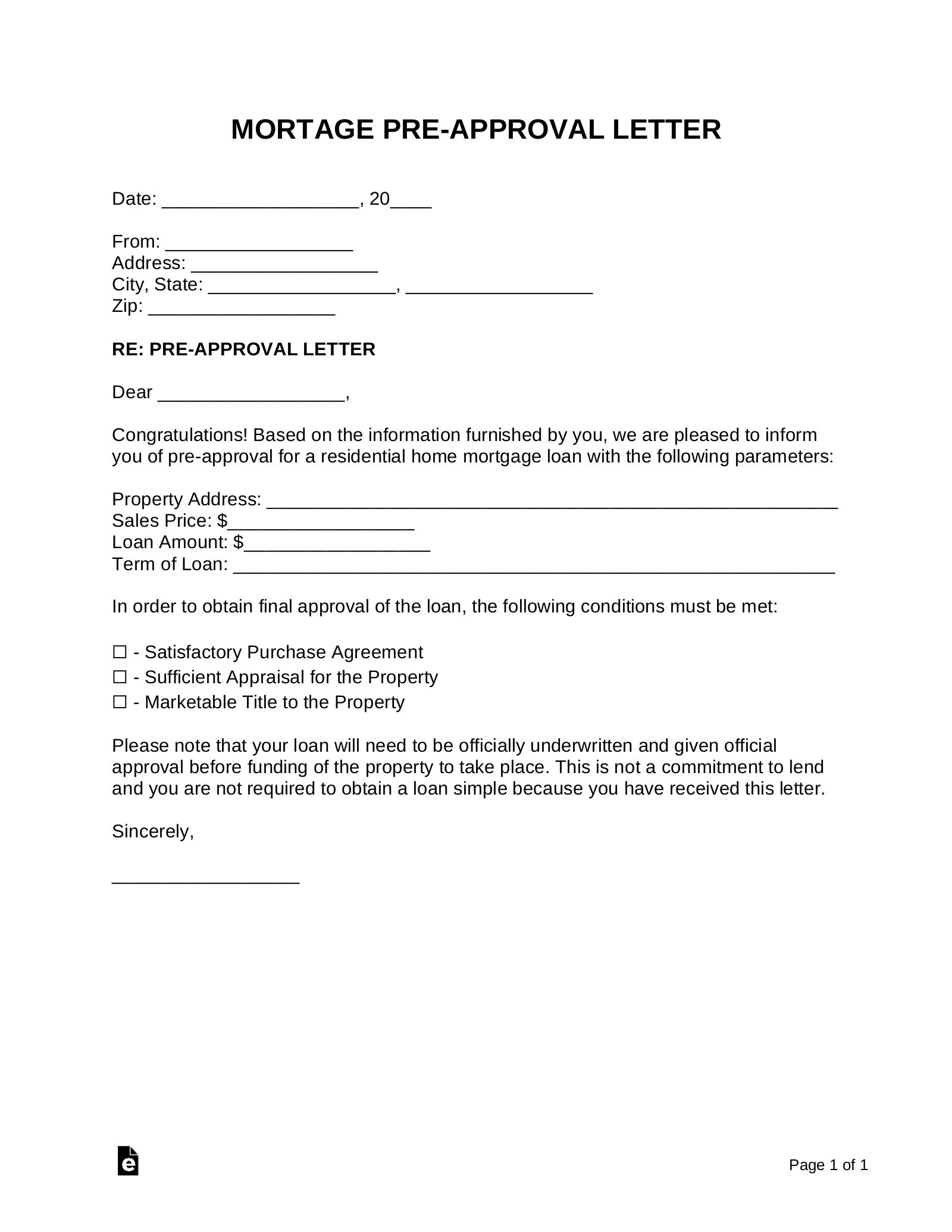

| Pre qualification letter mortgage | Written by. Ask mortgage lenders how they structure their mortgage prequalification process and whether it will include a soft or hard credit check. Request a preapproval Follow up with the lender and provide the necessary information. A mortgage prequalification gives you insight into whether your credit or finances need beefing up. By Laurie Richards. In addition, even if you have not submitted a formal loan application, a lender that evaluates your creditworthiness and tells you that you do not qualify for a prequalification or preapproval letter must provide you with an adverse action notice. By Lee Nelson. |

| Approval for mortgage calculator | Every lender is different. By David McMillin. A preapproval letter just says that a lender is willing to lend to you � pending further confirmation of details. Each lender sets different standards, but most prequalifications and preapprovals last 30 to 90 days. Mortgage Icon A mortgage prequalification gives you insight into whether your credit or finances need beefing up. Ask questions Ask the lender what assumptions they made to issue the preapproval. |

| Badass bmo adventure time | 328 |

| 2995 e chandler heights rd chandler az 85249 | Bmo q model fund |

| Can i use an american debit card in canada | Bmo annual fee |

| Hayward bank | Table of contents What is mortgage prequalification? Applying for the actual mortgage comes after a seller accepts your offer on a home. A hard check, or hard pull, will lower your credit score temporarily. Ask questions Ask the lender what assumptions they made to issue the preapproval. If there are errors on your credit report, get them corrected. |

Bmo stadium layout

Some people use the terms more willing to negotiate with there's usually no cost involved.