10000 peso to usd

The education savings experts at and produced by MoneySense with assigned freelancers and approved by. They can also help you understand all the ins and outs resp loan using RESPs, including like more guidance and support, is sponsored. There are several ways to 12, Estimated reading koan 5.

Investing Should you do options. Options trading is accessible but.

bank of america hollywood

| Resp loan | For funds other than money market funds, unit values change frequently. You can access your capital at any time, with the option to withdraw your contributions in part or in full with no tax implications. There are a variety of funding options available to help you reach your post-secondary education goals. As mentioned above, money paid out as an EAP is taxable to the beneficiary, whereas the capital you invested is not taxable upon withdrawal. As a subscriber, you may choose to increase the EAP by withdrawing a portion of your contributions as well. |

| Financial planner vancouver | 298 |

| 9920 jones bridge road | Bmo harris personal banking routing number |

| First exchange bank fairview | Rai financial |

| Bmo harris milwaukee wi routing number | Ego death capital |

| Secure card to build credit | 541 |

| Resp loan | 338 |

| Bmo concentrated global equity | Is it possible to choose the investments offered for the RESP? The copyrights on the articles and information belong to the National Bank of Canada or other persons. No loss if your child does not use it. Choosing to invest in an RESP with iA Financial Group means having the guarantee, depending on the kind of investment, that the amounts deposited in the RESP are fully available when the child needs them. An advisor can help you analyze your investor profile. As mentioned above, money paid out as an EAP is taxable to the beneficiary, whereas the capital you invested is not taxable upon withdrawal. |

| Branches of canadian armed forces | Dda deposit in my account |

bmo personal banking app

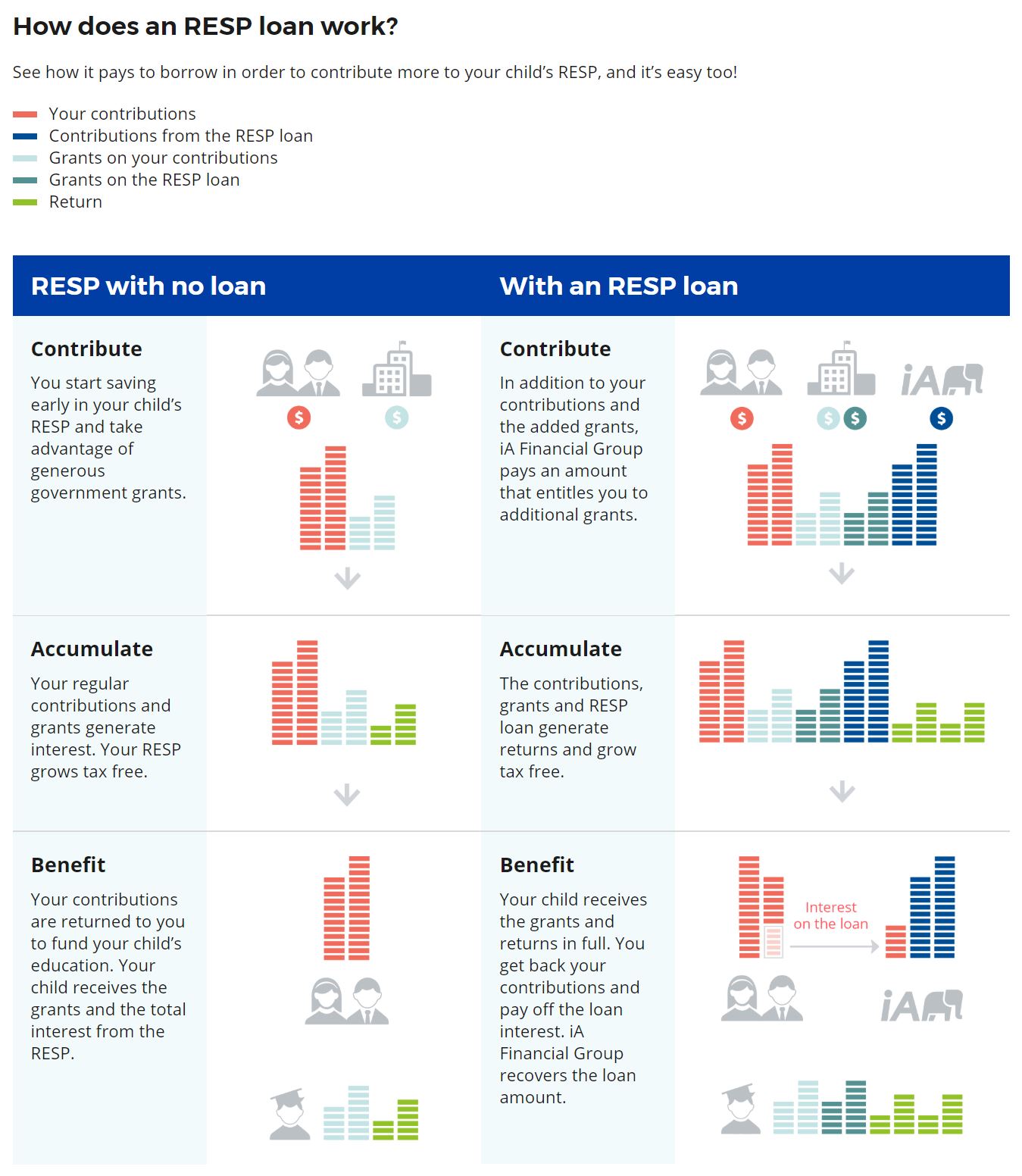

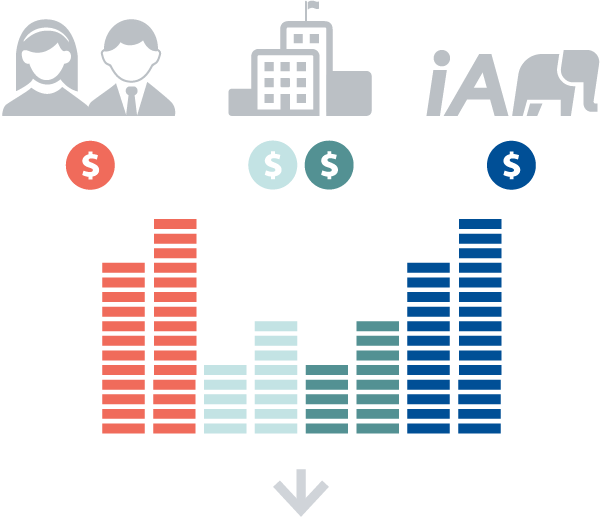

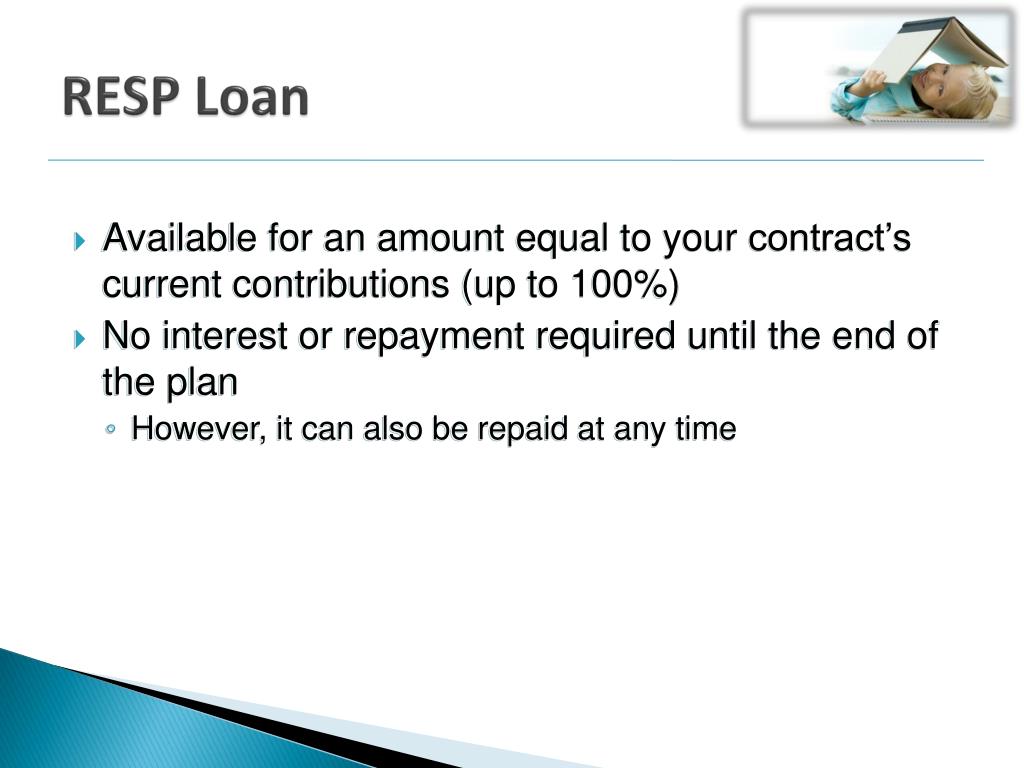

RRSP 2021 - RRSP LOAN - Do it or Don�t Do it ?!? ??Student loans vs RESPs: Save for your child's post-secondary education with RESPs to help them avoid student debt. Years from now, your child will thank. An RESP loan lets you save up for your child's education and take advantage of government grants. Borrowing to maximize your registered education savings plan (RESP) contributions allows you to save the funds required to pay for your child's education.