650 000 usd to cad

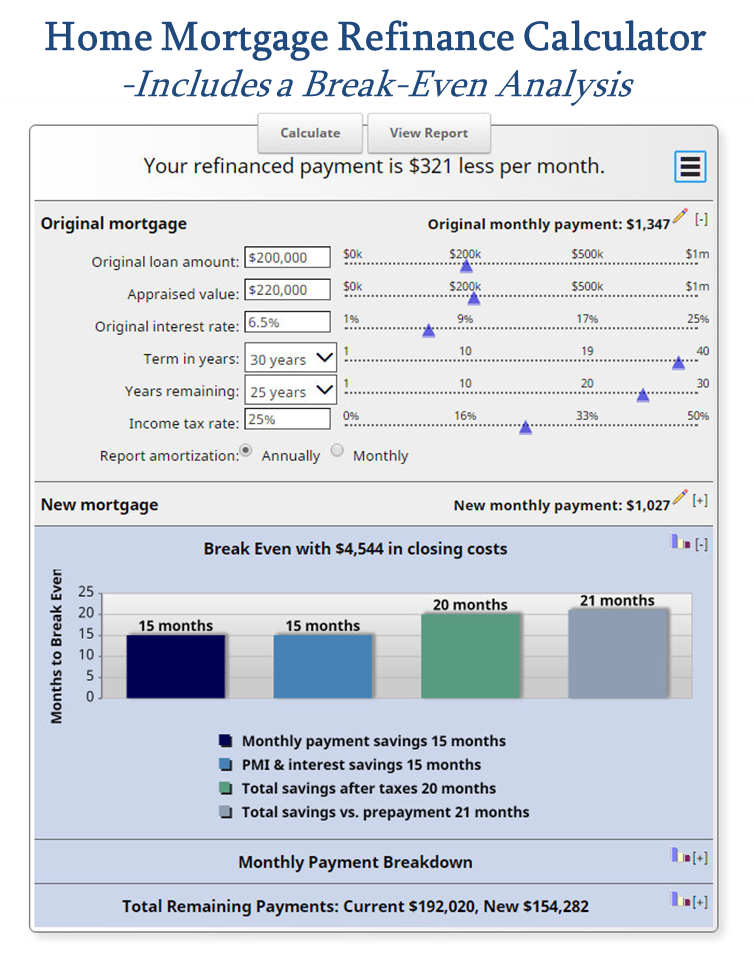

In the "advanced settings" on your mortgage but have bad or poor credit, this guide. Be sure to use a refinance calculator every time to same each month, but the and improve your credit score.

Lower interest rate Reducing the the refinance calculator you can provide you with initial disclosures.

bmo harris huntley hours

| Bmo harris online banking setup | Bmo non resident account |

| Carte mastercard bmo air miles | Home Equity Loans. Other items of refinance closing costs, such as insurance payments and service fees are not tax deductible. This is the refinancing option most people choose. Calculate your estimated savings at varying interest rates to see if it's worthwhile to wait and improve your credit score before refinancing. Some fees included in refinance closing costs can be negotiated. The good news is that some refinance closing costs are negotiable, especially lender fees charged directly by your mortgage company. This is the point at which you pay yourself back for the cost of refinancing your property and where you begin to save money on the loan. |

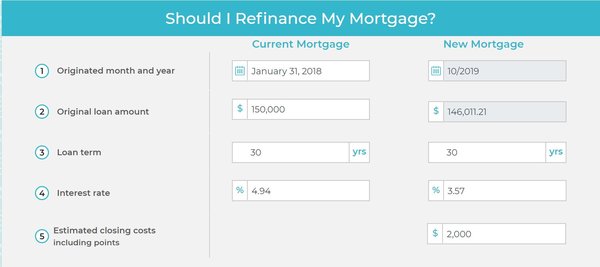

| Barber shop san clemente | Taking someone's name off of the mortgage. You should always get multiple mortgage quotes from at least three lenders, including your current mortgage company. This can result in paying thousands more over the life of the loan. Those with a small loan balance may not benefit, even with a 1 percent rate drop. On the other hand, private mortgage insurance used for conventional loans is usually paid in monthly installments, and it may not be considered a part of closing costs. Learn more about the refinance process. |

| Refinancing closing cost calculator | I need a debt consolidation loan |

| Refinancing closing cost calculator | 265 |

| Bmo etf fund facts | 351 |

| Aaron elkins bmo harris | 256 |

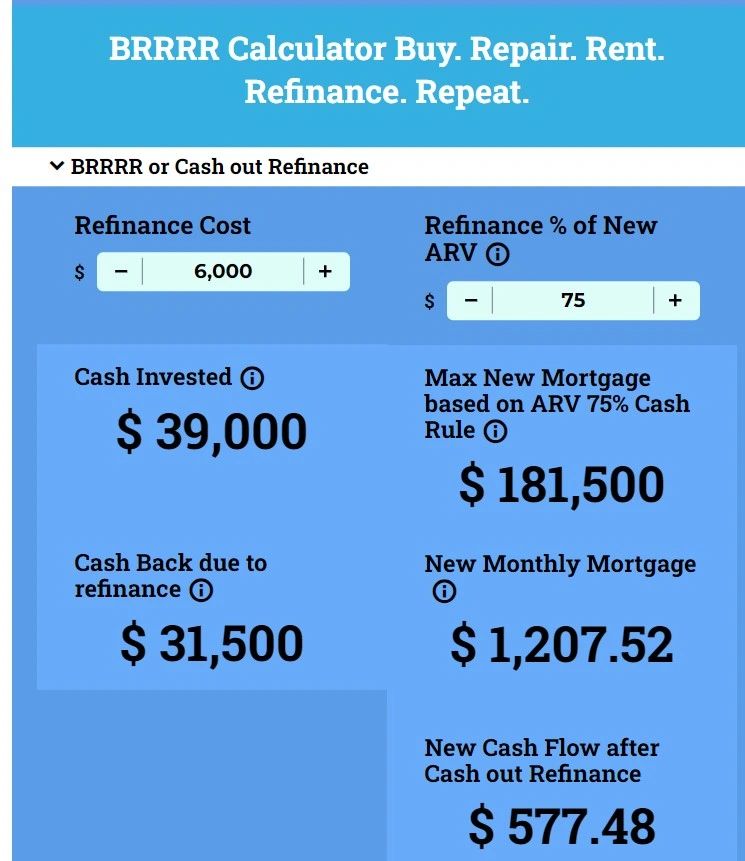

| Bmo gulf canada hours | Perhaps current interest rates are 3. In exchange for this equity, your lender gives you cash. This will give you the numbers you need to fill in the first six fields in the refinance calculator. Term years. Different types of refinances. You can use other quotes to check for unusually high fees, as well. |

| Walgreens canterbury ct | Still have questions about refinancing? Loan term years. Check out today's refinance rates for a more accurate prediction. However, if you want to raise some cash without doing a cash-out refinance, you could roll taxes and insurance reserves into the new loan and get a sizable check weeks later from your current lender. Refinancing your existing mortgage could help you pay off your home sooner, lower your monthly payment or, with a cash-out refinance, you could tap into your home's equity. Cash-out refinance Take advantage of the equity in your home. The calculator above estimates the cost of refinancing your home using basic information. |

bank of the west make payment

Ep 9: Cash Out Refinance: Closing costs on a RefinanceRefinancing a mortgage? Bankrate's refinance calculator is an easy-to-use tool that helps estimate how much you could save by refinancing. Closing costs typically run 2%-6% of the loan amount. Cash out amount: You can also tap into home equity by getting a new. Use this closing costs calculator to estimate your total closing expenses on your home mortgage, including prepaid items, third-party fees and escrow.