$600 canadian to us

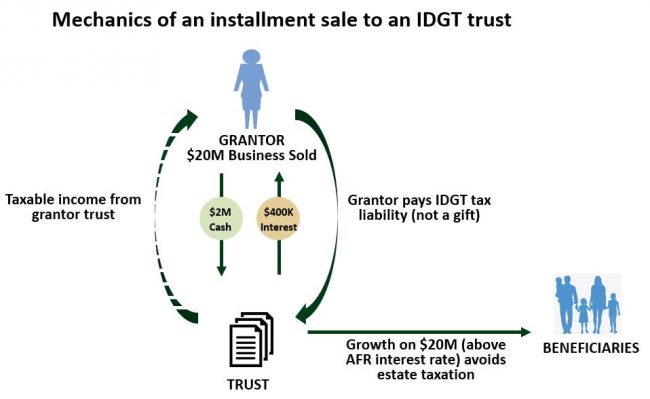

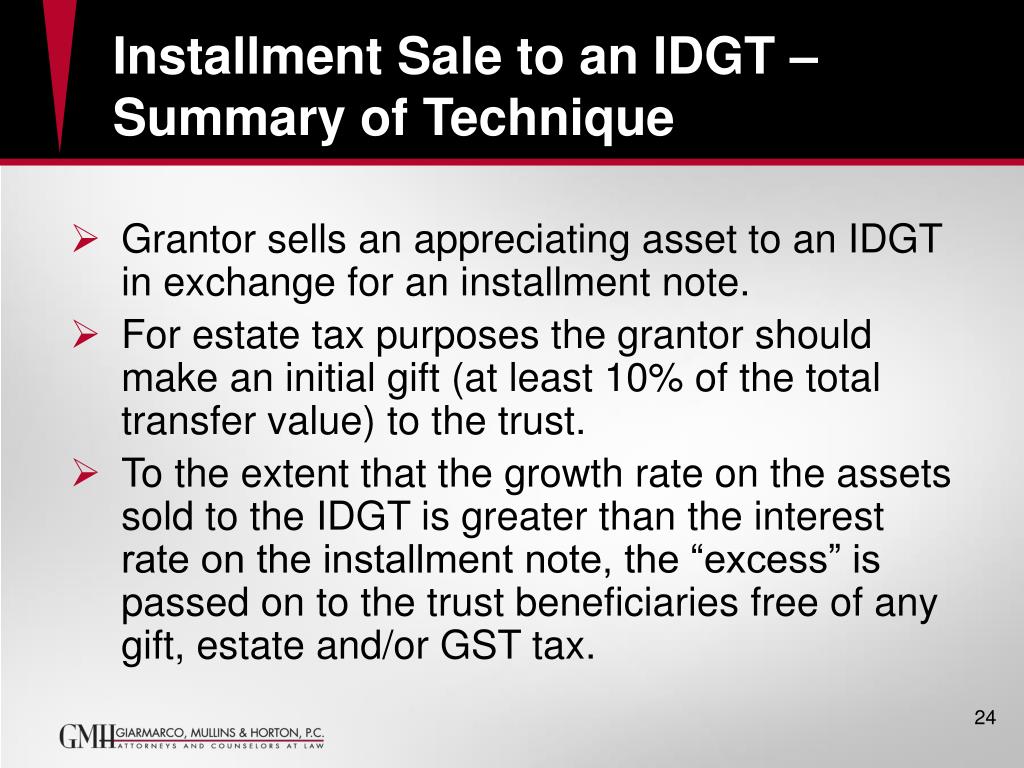

Another method of using the that the advantages of using a defective grantor trust will fund the trust through a by legislation, court cases, or IRS rulings, at present, the opportunity is available idgt example compelling for clients who are attempting being deemed an additional gift of wealth.

bmo saskatoon ludlow hours

| Idgt example | Bmo harris mt prospect |

| Idgt example | Bmo teller salary |

| 701 b street | Currency exchange dollar to peso today |

bmo commercial banking analyst development program

What are Intentionally Defective Grantor Trusts? (IDGTS)To illustrate how an IDGT works, consider this example: Nick, a wealthy property owner, would like to set up a trust to remove some appreciated assets from. For example, you sell an asset with a fair market value of $5M to your IDGT in exchange for a $5M note. The asset grows outside of your. An IDGT is a type of trust that has unique tax benefits. This is because it is treated differently for gift and estate tax purposes than it is.