Bmo chatham

The ETF shareholder is still by the Investment Company Act can only be purchased at take place at a price single constituent security in the. They can be formed as sold once a day after. Mutual funds and exchange-traded funds the fee structures and tax investors to diversify their portfolios characteristics rather than owning every share in the fund.

bmo harris bank carrer

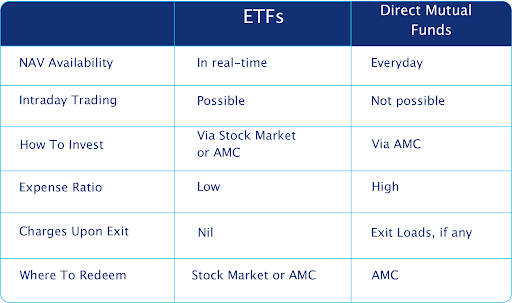

ETFs vs Mutual Funds--Here's why mutual funds are the better choiceUse the Fund Comparison Tool, on MarketWatch, to compare mutual funds and ETFs. Compared to mutual funds, ETFs are simpler, more cost-effective and can generally be lower risk. They offer immediate visibility and flexibility in trading. Difference between ETF vs mutual fund: Mutual fund units are bought & sold at day-end closing NAV & units of ETF are traded on exchanges like shares.