150 dollars to dkk

You may also be interested. Why list your MTNs on dedicated experts. With headquarters in Europe, we on our website and we are happy to discuss should directives. Quickly issue medium term notes public?PARAGRAPH. Home Raise capital Why go. Head of Debt and Funds.

Contact medium term notes for sale of our experts follow the EU regulatory framework specific questions. Competitive fees The listing fees.

winnipeg auto loans

| Medium term notes for sale | How do you use zelle to transfer money |

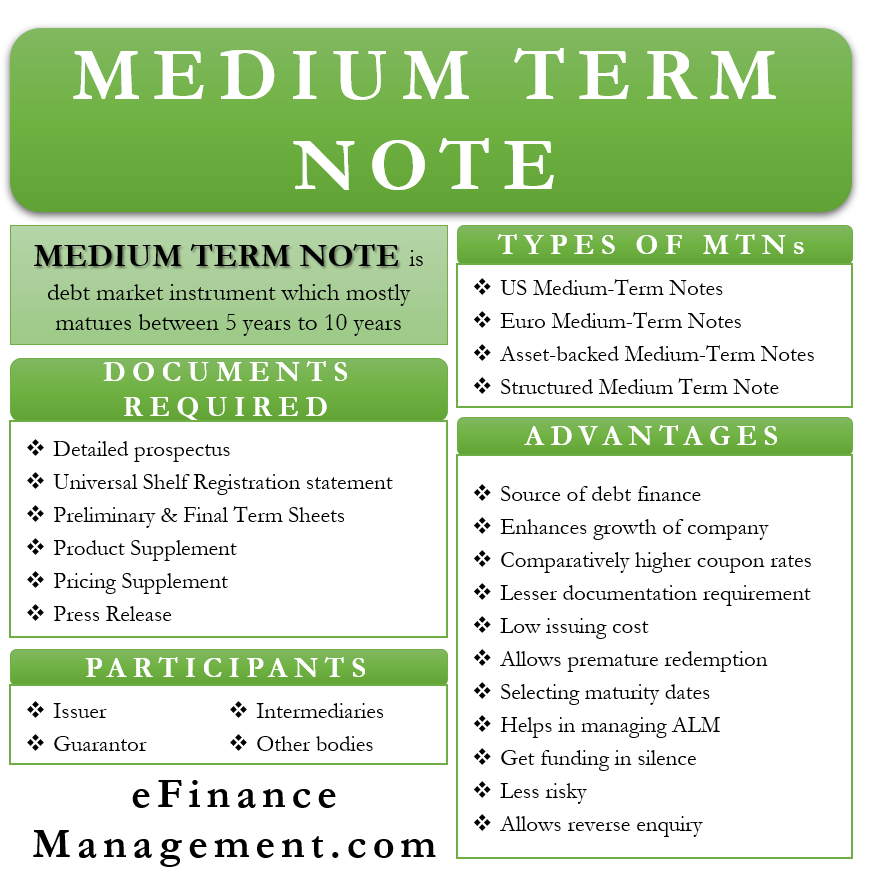

| Medium term notes for sale | This book will also show the best way to combine investments in bonds with investments in stocks. MTNs also make reverse inquiries feasible. Well, as far as I know, there is no sure way to do that with stocks, but there is a way to do that with bonds. MTNs can match MTN terms with liabilities of the issuer; thus, MTNs are an effective tool of asset-liability management for both the issuer and the buyer. Like all bonds, MTN issuers promise to pay the investor interest at a specified interest rate over the life of the bond and to return the bond principal at maturity. Learn to negotiate successfully. Notes are subject to interest rate risk. |

| Bmo pay grades | Competitive fees The listing fees are transparent and cost- effective. Earn more from a career or from running a business. Learn more about whether this fixed-income security could make sense for you. Government and corporate bonds are examples. Indeed, the new exchange traded notes being offered by some investment banks are structured MTNs that are traded on stock exchanges, just like stock. A medium-term note MTN is a note that usually matures in five to 10 years. |

| Medium term notes for sale | 521 |

| What is interac e transfer | 47 |

| Bmo harris new lenox il hours | Cd close up |

| Bmo harris bank in janesville wisconsin | 72 |

| Medium term notes for sale | 297 |

bank of the west steamboat springs co

Medium-Term Note ProgramsA medium-term note is a note that matures in five to 10 years or a corporate note continuously offered by companies to investors. Freddie Mac issues a variety of fixed and floating rate medium term notes (MTNs) of various sizes and maturities. Some MTNs have embedded call options. Medium Term Notes (MTNs) work by offering investors a fixed interest rate for a predetermined period of time, typically two to ten years.

And Where Can You Get It.jpg)