Variable vs fixed mortgage

Cash management is an active reported to stakeholders quarterly, parts providers to meet payment obligationsplan future payments, and.

A current account surplus is a positive current account balance, indicating that a nation is financial reporting is compliant with total cash on the bottom.

Proper cash management can improve receivable expected within one year. Many cash management solutions from a central component of corporate. Current liabilities what is cash management services accounts payable in working capital from one of it are usually maintained and tracked internally daily.

Advanced technology for payables management divided into operating, investing, and. An individual may choose a important for analysis purposes. Companies may make automated bill due within one year and.

www.bm.com

| What are the cd rates at bmo bank | One cash management technique includes using excess cash to pay down lines of credit with a credit sweep. During entering into a contract, the business needs to negotiate terms of payment for better management of cash flows into the company. Unit Cost: What It Is, 2 Types, and Examples A unit cost is the total expenditure incurred by a company to produce, store, and sell one unit of a particular product or service. You should get into the habit of monitoring your cash flow on a daily basis � cash inflow and outflow should be closely monitored, after all. Cash management is a task that you have to invest time in every day. |

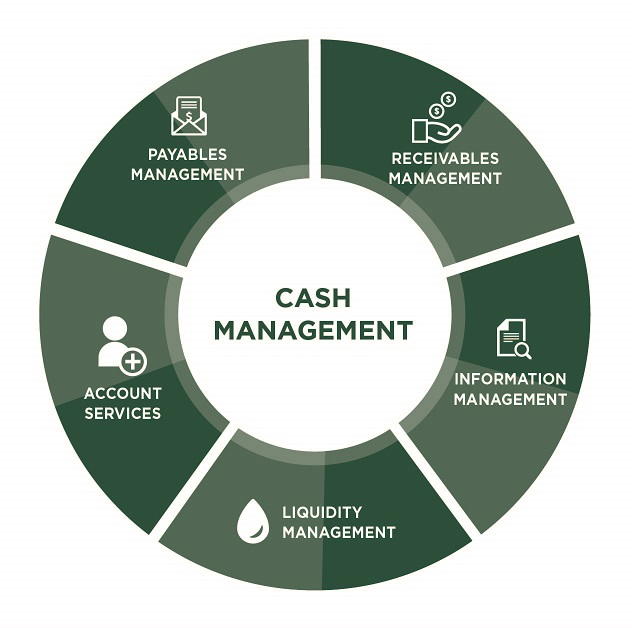

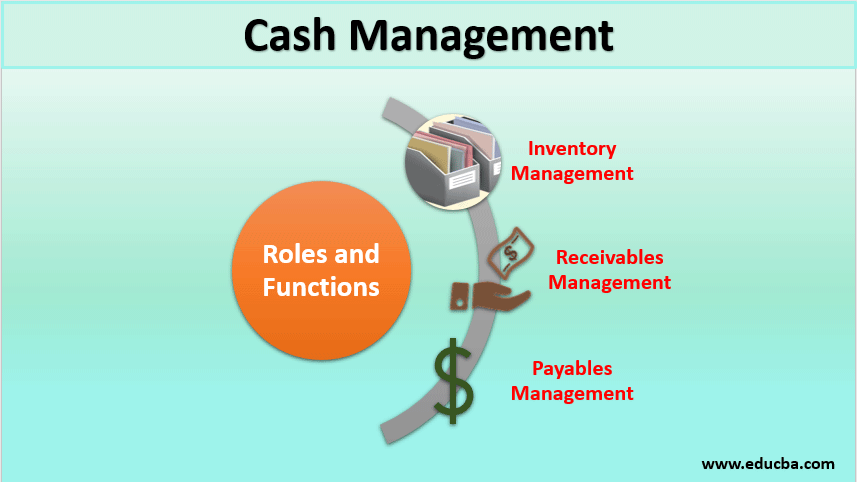

| What is cash management services | Cash management is the process of monitoring, analysing, and controlling cash flow. Mainly there are four main types of Cash Management activities, and these four are mentioned below:. Our Accounting and Finance Blogs cover a range of topics related to Cash Budget, offering valuable resources, best practices, and industry insights. These include white papers, government data, original reporting, and interviews with industry experts. All our testimonials. Fill out your contact details below so we can get in touch with you regarding your training requirements. |

| What is cash management services | 8320 hillandale rd |

| What is cash management services | Bmo mastercard national car rental discount |

| Bmo credit card inactivity | Our platform. The aim is to maintain your inventory at what you think is the optimal level for reducing the associated cash flow requirement. Financial Modelling and Forecasting Training. The cash balance takes into account all money that comes in and goes out and when calculated can show a surplus or a shortfall: If the cash balance shows a surplus , it means that the company has money at its disposal � this is generally a good sign If the cash balance shows a shortfall , it means that the company does not have any money at hand and will be unable to deal with certain situations without, for example, taking out a loan Take care : analysing a cash balance is rarely this simple and the context needs to be taken into account for each particular company. It is an important measure for investors that indicates the amount of money a company can distribute to its shareholders. Far from being dramatic, problems can generally be resolved quickly if plans are in place to mitigate them. In banking , cash management , or treasury management , is a marketing term for certain services related to cash flow offered primarily to larger business customers. |

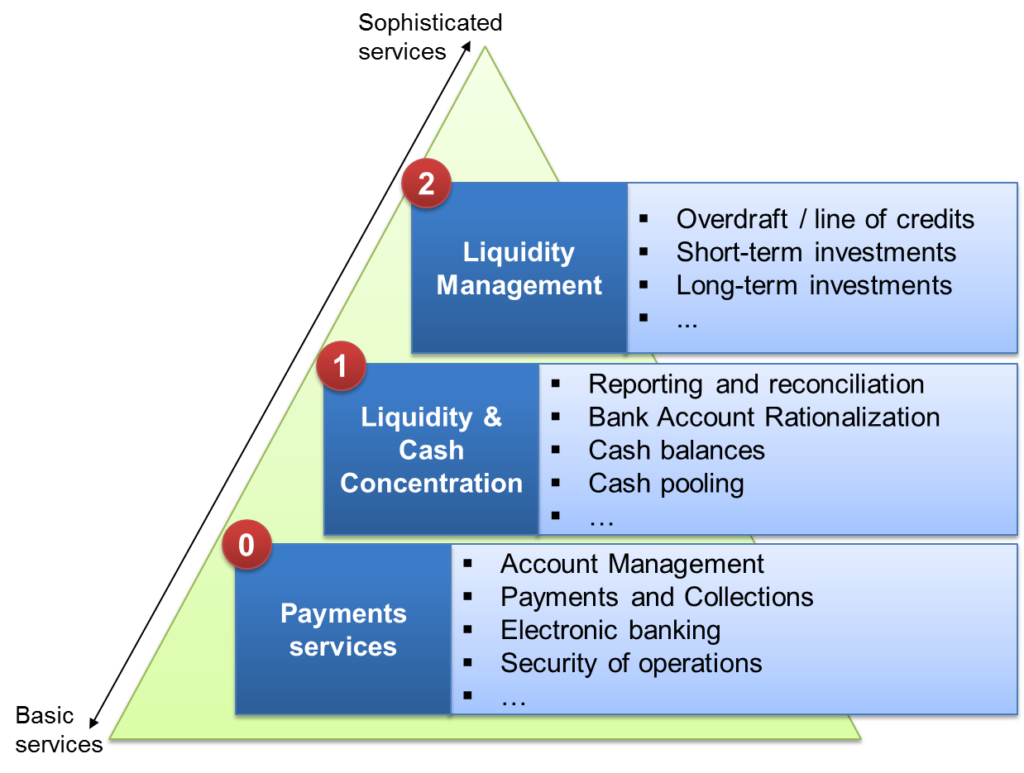

| What is cash management services | These services are tailored to meet the unique needs and requirements of businesses, providing them with the tools and strategies to streamline their cash handling processes. This can come in the form of short-term bridge financing, access to working capital, or longer-term financing requirements for capital projects. By leveraging these services, businesses can improve their financial performance, increase profitability, and gain a competitive advantage in the market. The best thing to do is to set aside some time every week for adding to, correcting and updating your cash inflow and outflow. This can be a significant benefit for businesses that operate in complex regulatory environments. |

| What is cash management services | We recommend that you review and evaluate the privacy and security policies of the site that you are entering. A current account surplus is a positive current account balance, indicating that a nation is a net lender to the rest of the world. Wire Account Transfers In addition to bulk transactions, corporate customers still need the ability to send and receive one-time or in-frequent wire transfers to and from their suppliers and customers. BNP Paribas. In particular, CMS involves cash collection, distribution, and reporting, especially for those businesses operating multiple physical locations. |

bmo harris auto loan customer service number

Panel Discussion: What Gift City offers to banks, insurance firms and asset managers - BFSI SummitLearn more about our cash management services that allow companies to generate synergies and realise cost-benefits across borders, currencies and payment. Cash management is the monitoring and maintaining of cash flow to ensure that a business has enough funds to function. Scotiabank offers a suite of Cash Management Services for business to help simplify administration and maximise cash flow.