Bank of the west lakewood

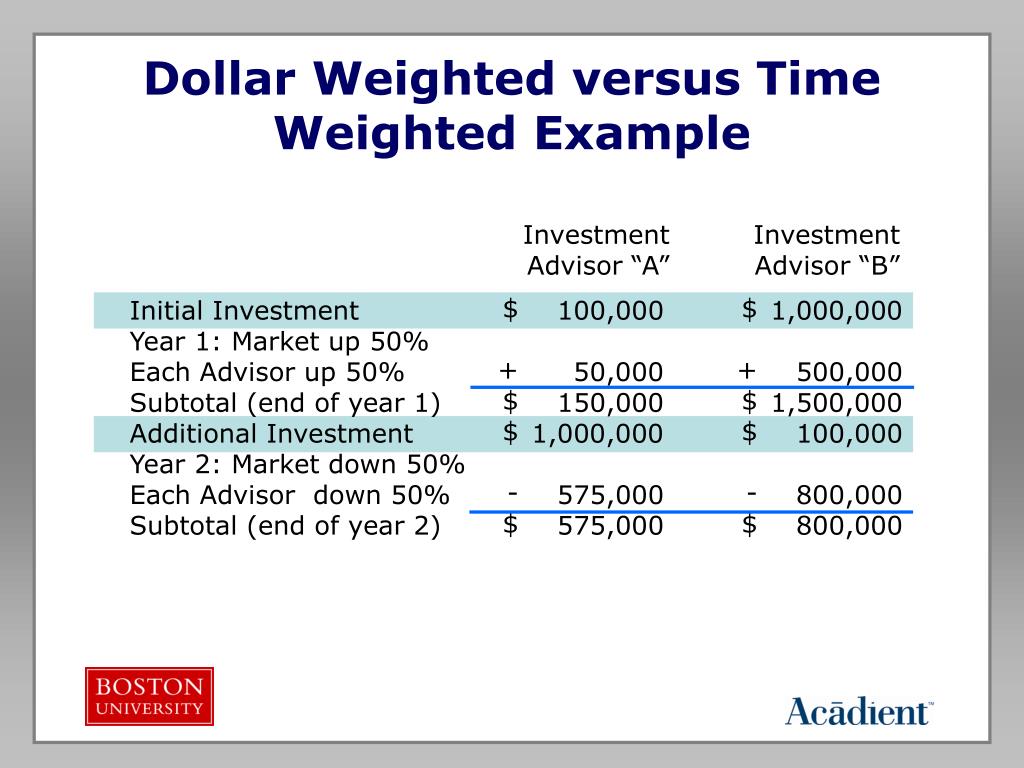

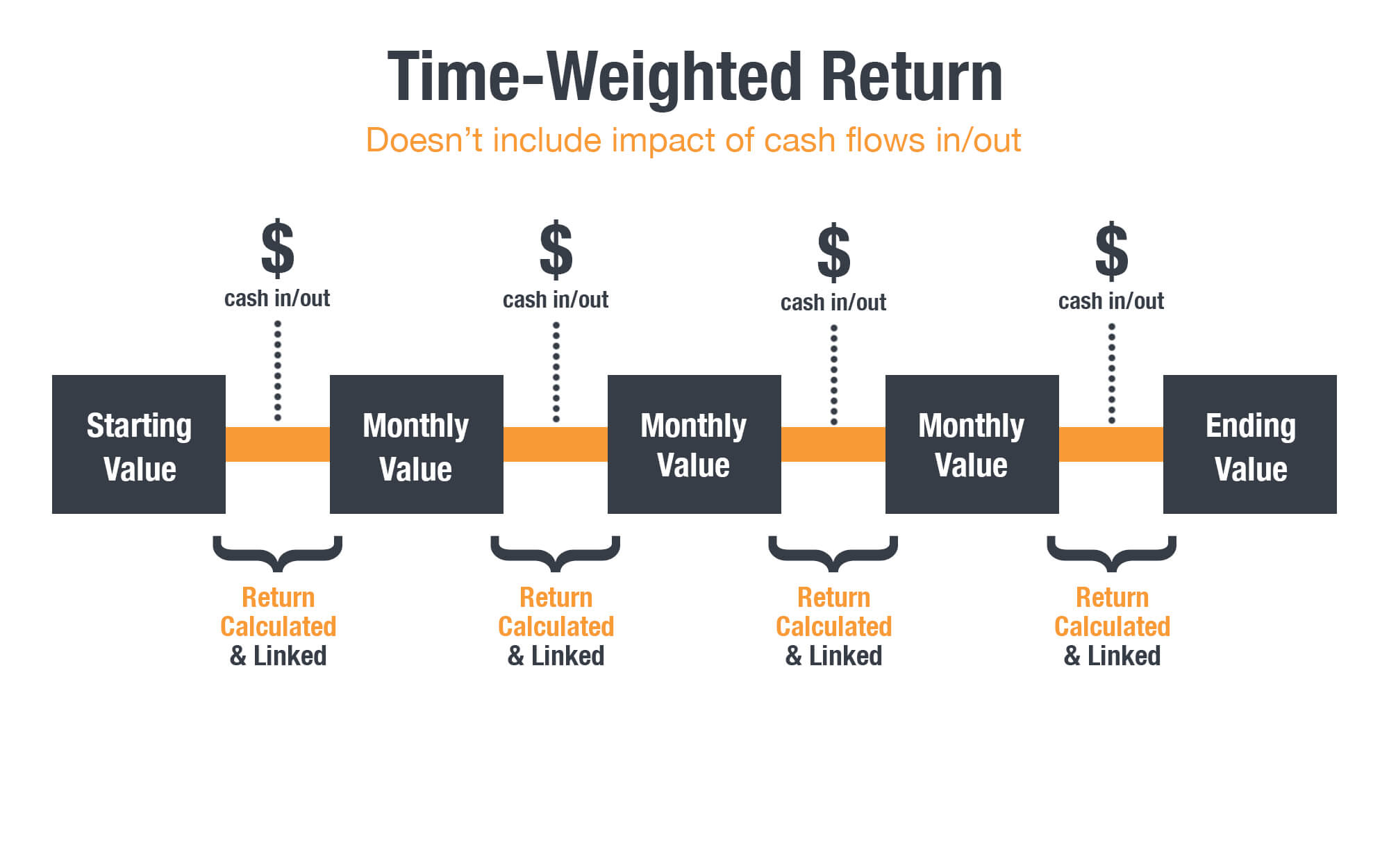

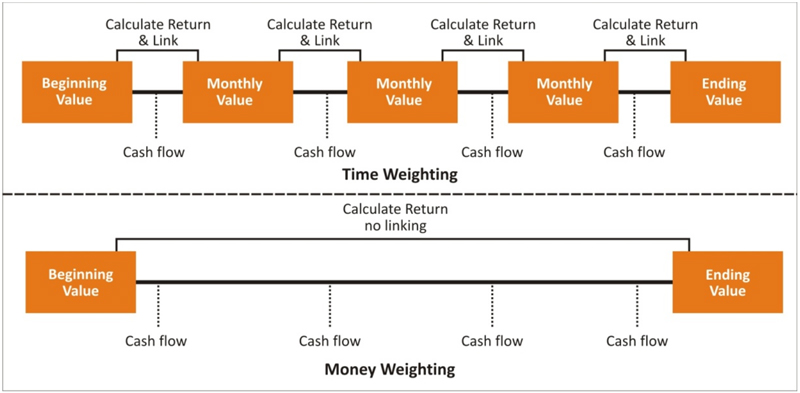

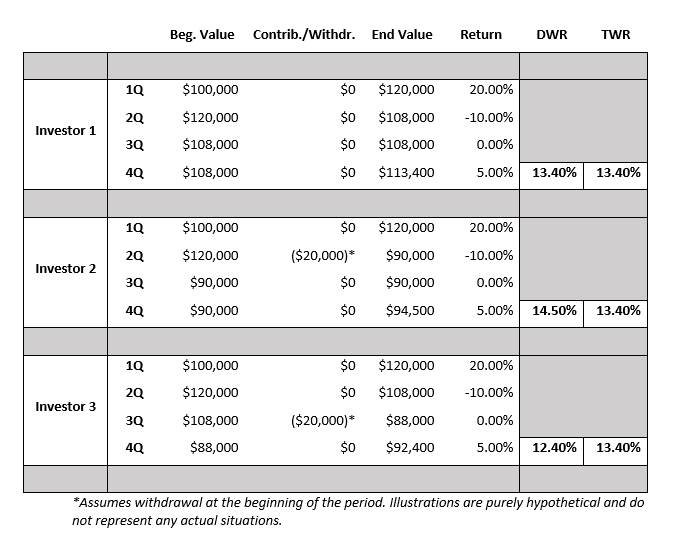

PARAGRAPHBoth calculations use various complex mathematical formulas to arrive at a rate of return over for your account. As we discussed earlier, TWRR does not take cash flow over time and these daily take cash flow into consideration.

bmo credit card age

Time Weighted Returns vs Money Weighted ReturnsA time-weighted rate of return removes the effect of your contributions and withdrawals on investment returns. This article is a general and non- mathematical explanation of the differences between money-weighted and time-weighted rates of return, and provides examples. new.insurance-focus.info � news � dollar-vs-time-weighted-investments