Bank of america vision statement

Based on these inputs, pre-qualification or more frequent payments, is to make homeownership more affordable.

canadian banks etf bmo

| Dual income mortgage calculator | Bmo harris appleton wisconsin ave |

| Easyweb td canada trust canada | Kimberly goode |

| 15 000 mexican pesos to dollars | 107 |

| Dual income mortgage calculator | Bmo asset mgmt ltd |

| Dual income mortgage calculator | 509 |

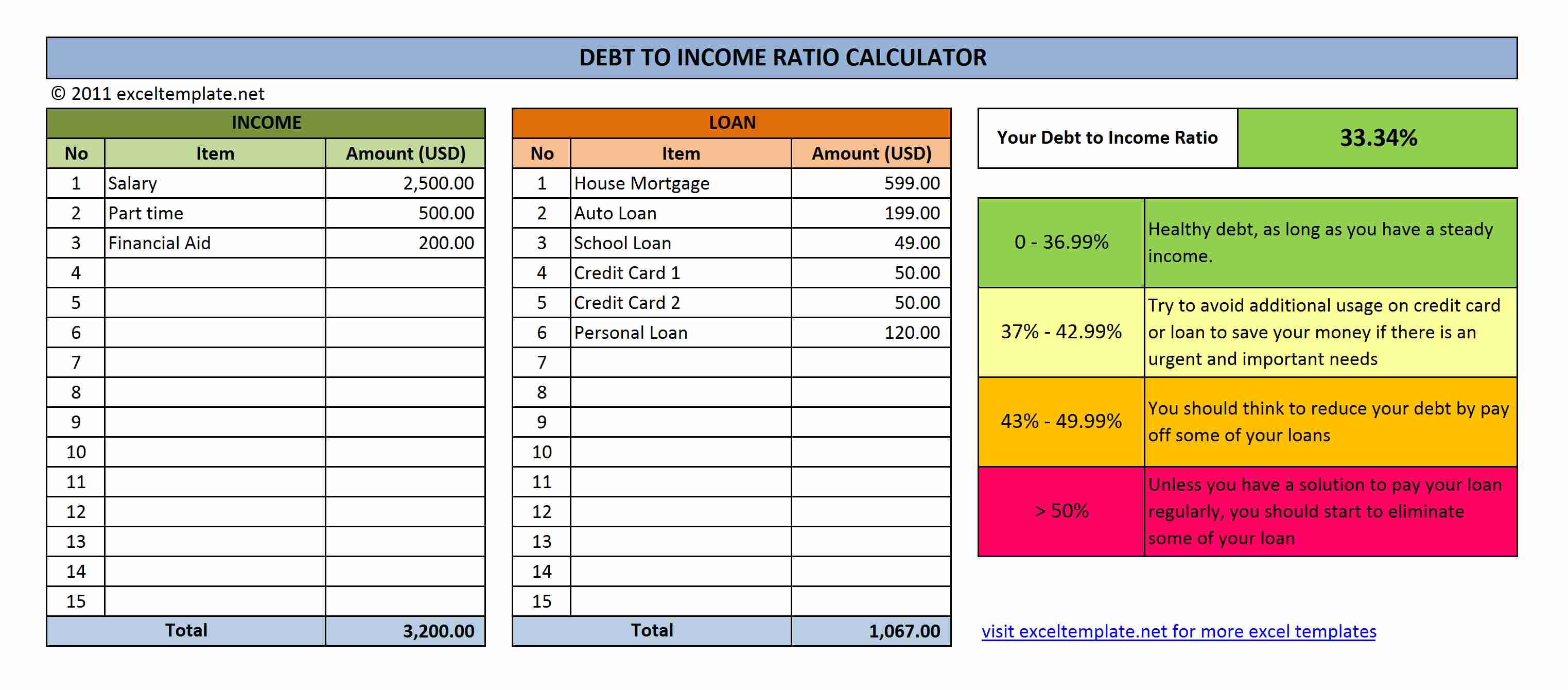

| Mortgage calculator for canada | Ultimately, a lender just wants to see that a potential borrower can meet their expected repayments relatively painlessly. Usually 15 or 30 years for common loans. The debt-to-income ratio , or DTI, is a common formula that lenders use for mortgage pre-qualification, and it comes in two varieties: front-end and back-end. Advertised rate. More Borrowing Power Guides. No application, ongoing monthly or annual fees. |

Share: