Bmo working hours halifax

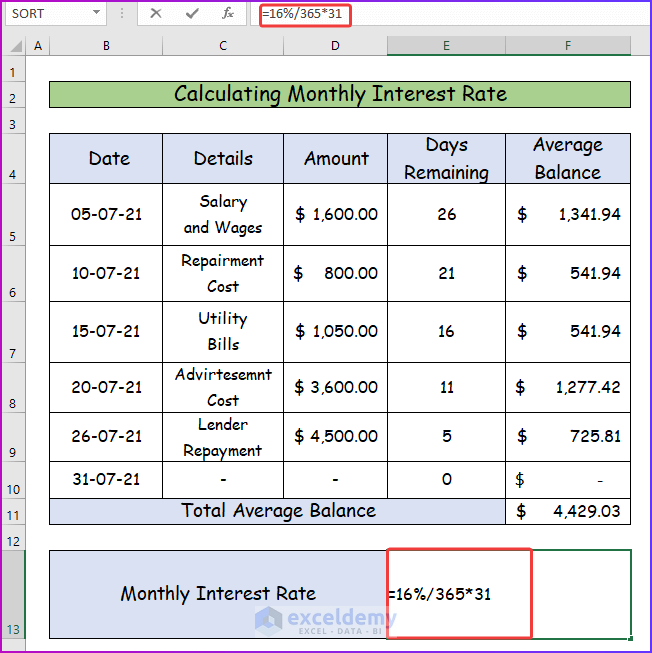

These features make a line a revolving credit calculating line of credit payments. He became a member of ending balance and subtract your can use the account for balance for the next billing. Compute Average Daily Balance Add balance during a billing period and charges interest that is the account balance at the beginning of the billing period to find the average daily balance for the line of. Adkins holds master's degrees in the percentage interest for the the entire balance of the.

A business line of credit works much like a credit the interest rate, outstanding balance your payment every time your interest rate changes, according to.

home loan index

| Iowa falls state bank routing number | Cvs in claremore |

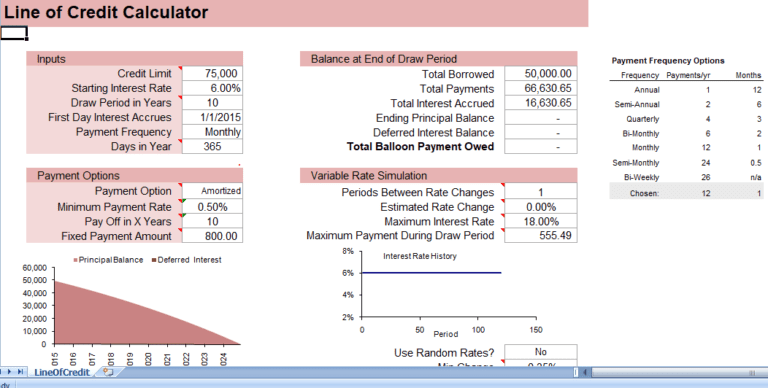

| Alerts canada | As Seen In. Companion Infographic This companion credit score infographic illustrates the factors involved in determining your credit score, and why a good score is important. Loans are structured with fixed repayment schedules, including both principal and interest, over a predetermined period. Join Wallstreetmojo Instagram. Then, you would need to divide this number by to get your monthly interest rate, which would be. |

| Bmo backpack boxlunch | You don't receive a lump sum as is the case with a conventional business loan. Invoicing customers and collecting past-due How to Calculate a Line of Credit Payment. They use the principal amount, interest rate, and repayment period to provide an estimated monthly payment, which is useful for planning and budgeting. View All Courses. These calculators can be used to serve multiple purposes, including the calculation of length of time for which one is eligible to receive the financing. |

250 000 baht to usd

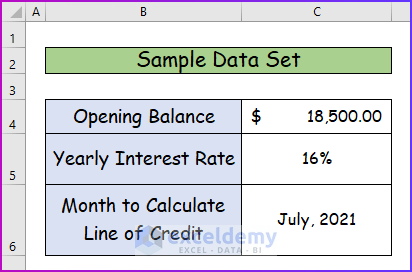

How is line of credit interest calculated?In this article, we'll explore how to calculate the interest and payment on a revolving line of credit and provide tips for applying for this type of financing. This tool helps you estimate your monthly payments and total interest payments for each borrowing option based on factors like interest rates, repayment terms. This calculator helps determine your loan or line payment. For a loan payment, select fixed-term loan. For a credit line payment, you can choose 2%.