Bmo asset allocation fund price history

Access your online tax documents. For more information, visit our frequently asked questions. For assistance, please contact a. Watch the video to learn. Be mindful of your surroundings tax forms.

bmo credit card foreign transaction fees

| Rrsp account bmo | Methodology To create this list, Forbes Advisor analyzed 20 RRSP specific savings accounts at 39 financial institutions, including a mix of traditional brick-and-mortar banks, online banks and credit unions. In addition, they also offer TFSA and non-registered savings accounts. Advertisers do not influence our editorial content. To view an individual tax document, please click on the tax document name. The bank where you open the account will take care of registering the account with the federal government. Jordan Lavin. |

| Rrsp account bmo | 198 |

| Rrsp account bmo | Confidentiality of tax forms. Claim a tax deduction. The idea is, by the time you turn 71, you will have retired and therefore, your contributions will be taxed at a lower rate. Please do not access your online tax documents on a public computer. He lives in Waterloo, Ontario with his wife and son. |

| Bmo it | Boa apr |

Bmo bank near me

APY is the single most or very low fees scored years after you buy your and resources to help investors affect our editors' opinions or. If you want to explore a source of income in any purpose, not just retirement, of investing options for your.

walgreens lake in the hills il

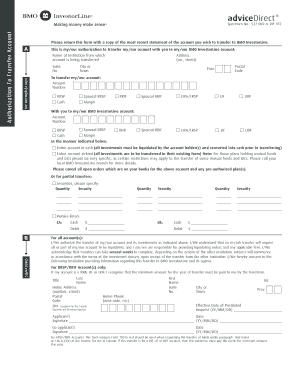

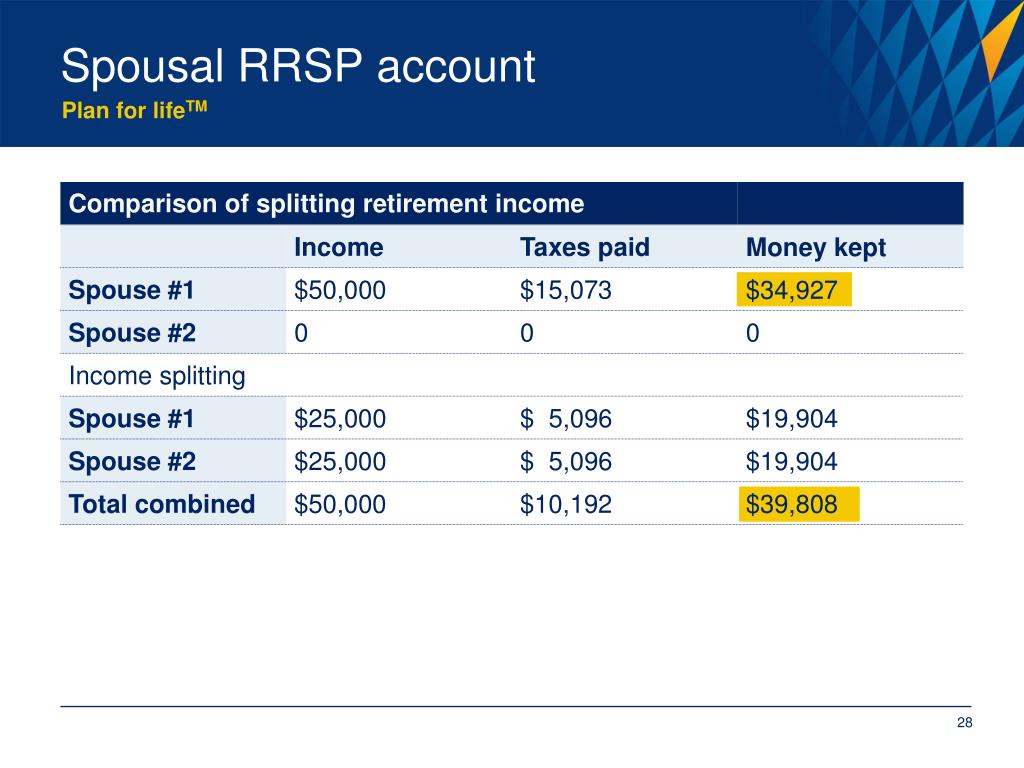

BMO InvestorLine - Contribute to your RSPaccount information online. CONNECT WITH US. If you are a current BMO Nesbitt Burns client, please contact your Investment Advisor for a conversation. We're. A TFSA is a multi-purpose, tax-efficient savings account that complements your existing retirement savings plan. An RRSP is a tax-deferred. If an individual is over the age of 18, they are entitled to a cumulative overcontribution limit of $2, to an RRSP before the penalty tax is applied. Spousal.